**Can We Pump Bitcoin? Understanding the Dynamics of BTC Price Movements**

**Introduction**

Bitcoin, the pioneer of cryptocurrencies, continues to capture global attention with its volatile price movements. Whether you’re a seasoned investor or a curious newcomer, understanding the factors influencing Bitcoin’s price fluctuations is crucial. One common phenomenon discussed in the cryptocurrency community is “pumping” — but what exactly does it mean, and can we predict or control it?

**What is “Pumping” in the Context of Bitcoin?**

In the realm of cryptocurrencies, “pumping” refers to coordinated efforts by a group of investors or traders to artificially inflate the price of a particular coin, in this case, Bitcoin. This can be achieved through various tactics such as spreading positive news, generating hype on social media platforms, or even manipulating trading volumes. The goal is to create a rapid and often short-lived increase in the price of the asset, allowing those involved to profit from the uptrend.

**Factors Influencing Bitcoin’s Price Movements**

Several factors contribute to the volatility and price movements of Bitcoin:

1. **Market Sentiment:** Public perception, media coverage, and general sentiment towards cryptocurrencies can significantly impact Bitcoin’s price. Positive news, such as adoption by major institutions or regulatory clarity, often leads to price increases.

2. **Supply and Demand:** Like any asset, Bitcoin’s price is influenced by supply and demand dynamics. The finite supply of 21 million coins and increasing institutional interest contribute to its value proposition.

3. **Market Manipulation:** Despite its decentralized nature, the cryptocurrency market is susceptible to manipulation. Pump and dump schemes, where coordinated groups inflate prices artificially before selling off, can create false impressions of market strength.

4. **Technological Developments:** Advances in blockchain technology, scalability solutions, and improvements in security can affect Bitcoin’s price. These developments signal long-term viability and influence investor confidence.

**Can We Predict or Control Bitcoin Pumps?**

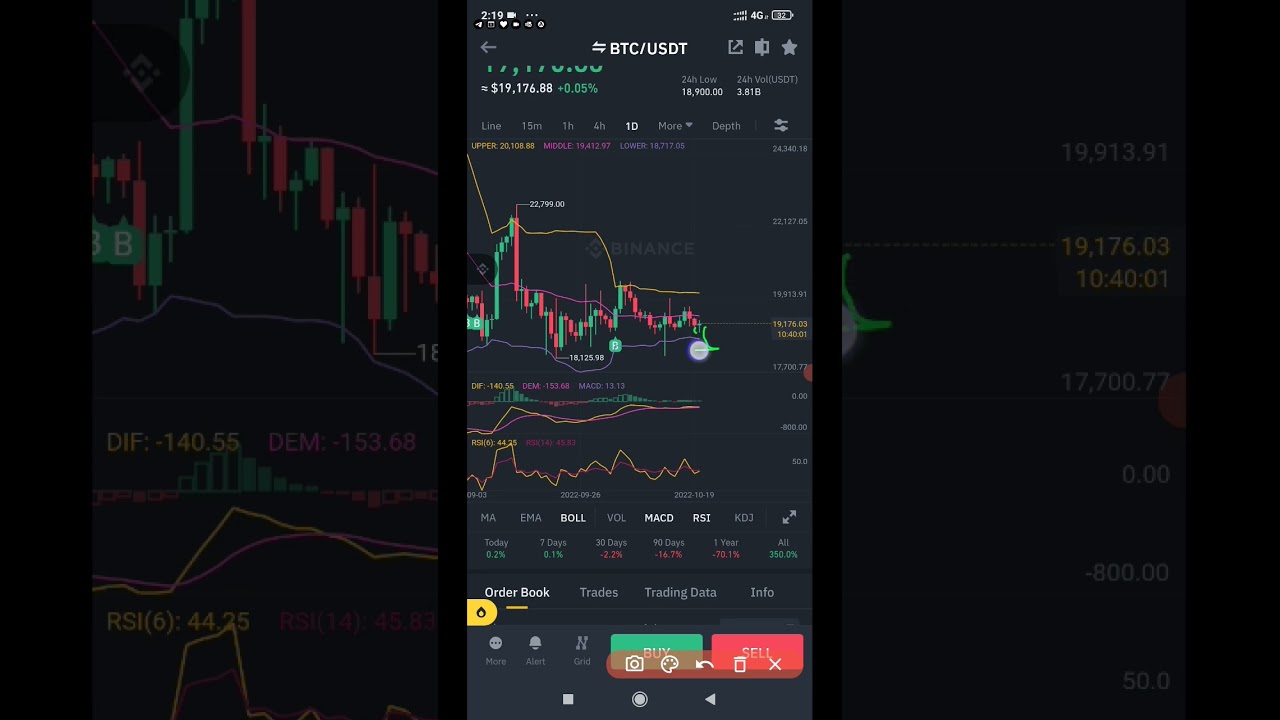

Predicting Bitcoin pumps accurately is challenging due to the market’s inherent volatility and the influence of external factors. While technical analysis and market indicators can provide insights into potential price movements, sudden pumps often occur without warning. Regulatory actions, global economic events, or geopolitical tensions can also trigger significant price swings.

Controlling Bitcoin pumps is another matter entirely. While traders and investors may attempt to capitalize on short-term price movements, sustainable growth and value appreciation are typically driven by broader market fundamentals and adoption trends. Long-term success in Bitcoin investment often requires a deep understanding of its underlying technology, market dynamics, and risk management strategies.

**Conclusion**

In conclusion, while the concept of “pumping” Bitcoin exists and can lead to short-term price spikes, sustainable growth in Bitcoin’s value is rooted in broader factors such as technological advancements, market adoption, and regulatory developments. As the cryptocurrency landscape evolves, investors should remain vigilant, informed, and cautious of speculative activities that could undermine the integrity of the market.

Understanding the dynamics of Bitcoin’s price movements empowers investors to make informed decisions and navigate the complexities of the cryptocurrency market effectively. By focusing on long-term value and staying abreast of market trends, individuals can position themselves to benefit from the transformative potential of Bitcoin and blockchain technology.

**Sources:**

– CoinDesk

– Investopedia

– Bitcoin.org