Introduction

Trading is well known for its volatility, especially with cryptocurrencies. Dealers frequently look to take advantage of these price movements and attempt to prognosticate them. One possible system is specialized analysis and price volatility pointers suchlike Average True Range( ATR). For numerous dealers, it’s a precious tool to understand and add to their specialized analysis toolkit.

What is Average True Range?

ATR was created by specialized criticJ. Welles WilderJr. in 1978 as a tool to measure volatility. ATR has since come one of the most well- known forms of specialized volatility pointers.

It’s now a significant part of other pointers that identify the directional movement of requests, similar as Average Directional Movement Index( ADX) and Average Directional Movement Index Rating( ADXR). With ATR, dealers try to determine an optimal period to trade unpredictable swings.

The index calculates the request’s average price of means within a 14- day range. ATR does not give trend information or price direction but offers a view of price volatility during that period. A high ATR implies high price volatility during the given period, and a low ATR indicates low price volatility.

When determining if they want to buy or vend means during the period, these low or high price volatilities are what dealers consider. It’s important to note that ATR only approximates price volatility and should be used solely as an aid.

How do you calculate Average True Range?

To calculate ATR, you must find a given period’s topmost true range or TR. This means calculating three different ranges and picking the topmost of the three

The rearmost period’s high abated by the rearmost period’s low

The absolute value( ignoring any negative sign) of the rearmost period’s high minus the former close price

The absolute value of the rearmost period’s low minus the former close price

The period can vary depending on the dealer’s focus period. For illustration, with crypto, the period could be 24 hours, while for stocks, it may be a single trading day. To determine the average true range over a period of time( generally 14 days), the true range is calculated for each period and added, and a simple normal is taken.

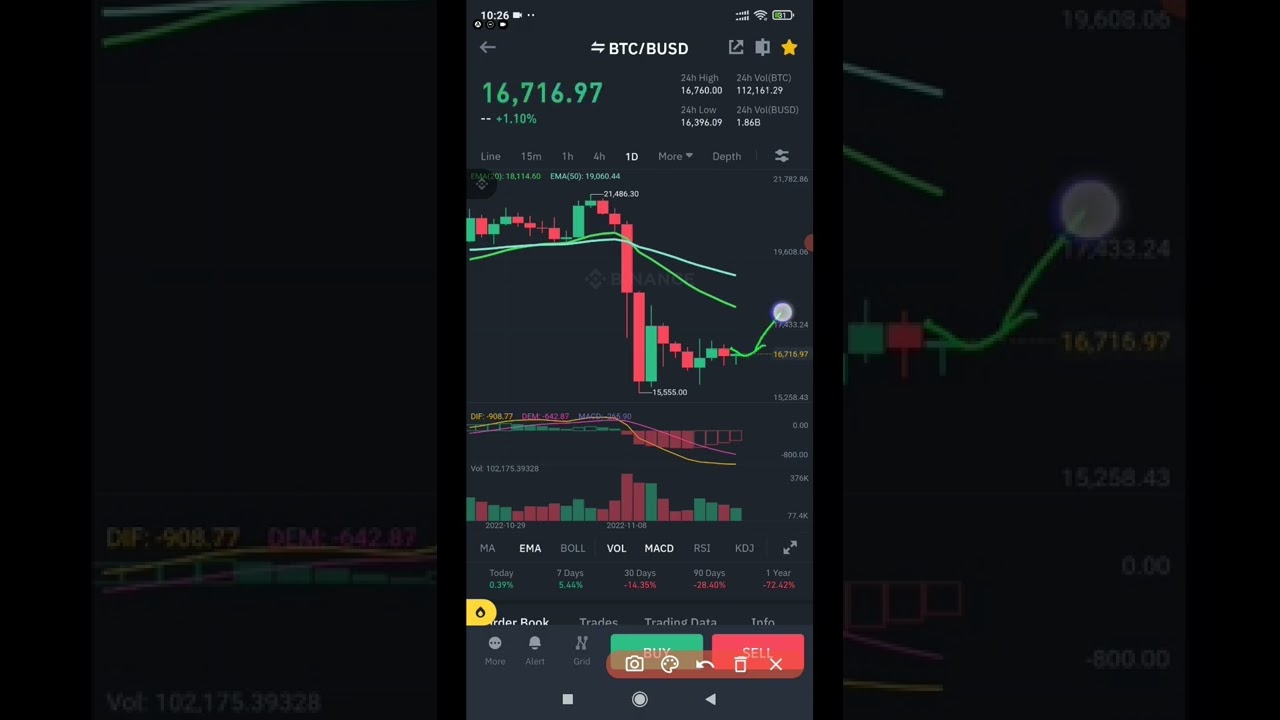

Determining the ATR of said period allows dealers to learn about the volatility of asset prices during that time. generally, a dealer will see ATR displayed as a line on their maps. Below, you can see that the ATR line rises as volatility increases( in either price direction).

Why do cryptocurrency traders use Average True Range?

Cryptocurrency dealers frequently use ATR to estimate price volatility during a period. ATR is particularly salutary in crypto due to the high volatility seen in crypto requests. One common strategy is to use ATR to set take- profit and stop- loss orders.

When using ATR in this way, you can avoid request noise affecting your tradingstrategies.However, you do not want diurnal volatility closing your positions beforehand, If you are trying to trade a suspected long- term trend.

A typical system is multiplying the ATR by1.5 or 2, also using this figure to set the stop- loss under your entry price. The diurnal volatility should not reach your stop- loss detector price; if it does, it’s a good index that the request is moving significantly down.

What are the drawbacks of using Average True Range?

While ATR provides benefits to its druggies for its rigidity and price change discovery, it comes with two main disadvantages

1. ATR is frequently open to interpretation. This can be a disadvantage as no single ATR value can easily specify if a trend will be reversed or not.

2. As ATR only measures price volatility, it does not inform dealers of the change in an asset’s price direction. One illustration is when there’s a unforeseen increase in ATR, some dealers might believe it’s attesting an old overhead or down trend, which can be false.

Closing thoughts

ATR is vital in numerous dealers’ toolkits for understanding volatility patterns. As volatility is a crucial consideration in cryptocurrency trading, it’s particularly well- suited for digital crypto means. Its strengths lie in its simplicity, but do take note of its limitations if you decide to experiment with it in your trading conditioning.